This week, each class has taken part in a Financial Literacy lesson where they have focused on a different aspect of money and finance. Take a look at what each year group have been up to.

Reception

For Financial Literacy Week, Reception have been learning through play by exploring our very own class shop in the provision area. The children have been buying items with price tags up to 10p, using coins to match the correct amounts. They’ve taken turns being shopkeepers and customers, using a till and shopping bags to make the experience feel real. This fun activity has helped develop their early understanding of money, value, and the basics of spending in an engaging and hands-on way.

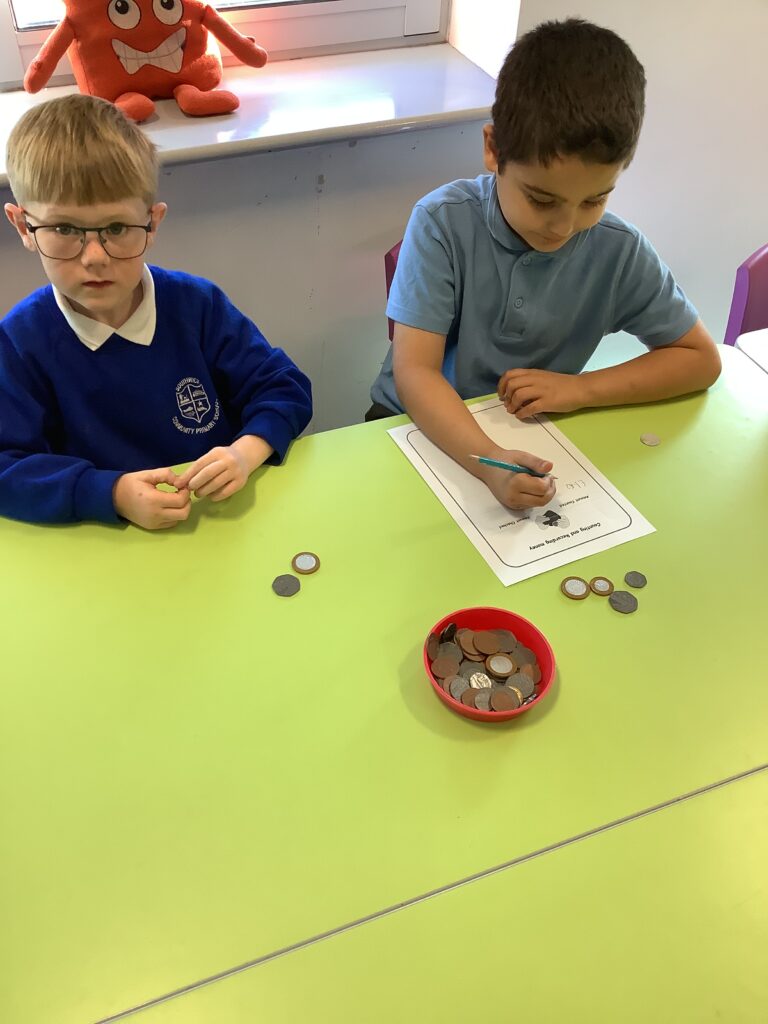

Year 1

In this engaging maths lesson, children explored the exciting world of money!

We learned to recognise and understand the relative value of different coins and notes, comparing them to see how much each was worth.

Through five different hands-on activities, children practised handling coins and notes, adding money amounts, and making choices just like real shoppers.

By the end of the lesson, they felt more confident recognising, counting, and using money in everyday situations.

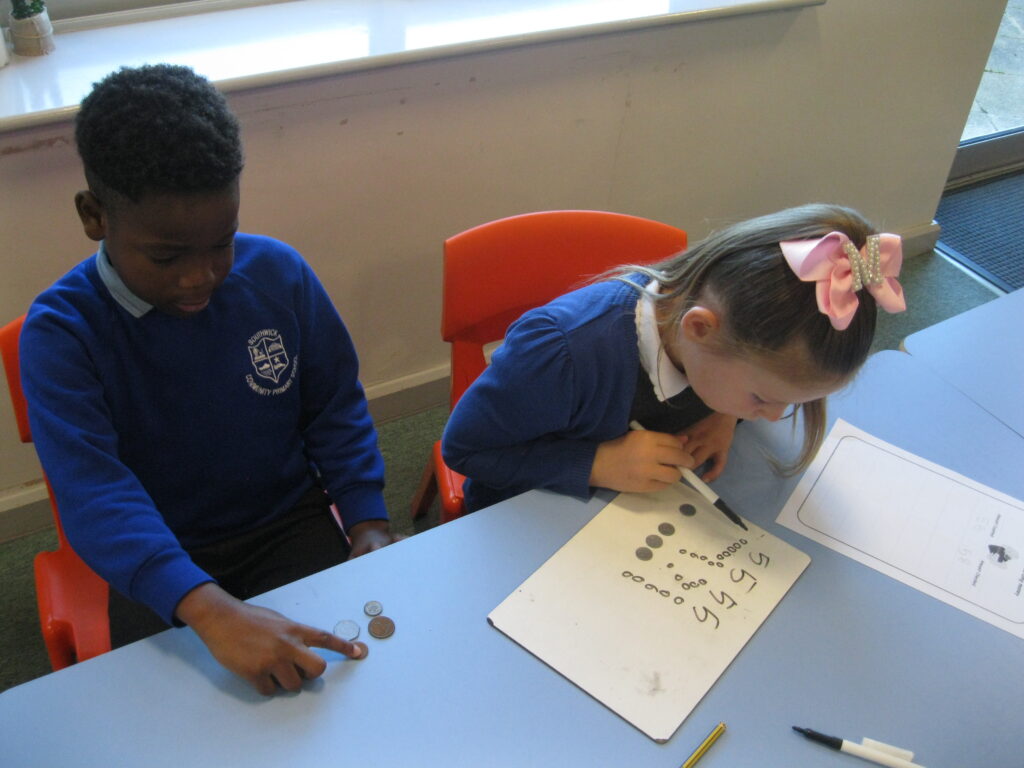

Year 2

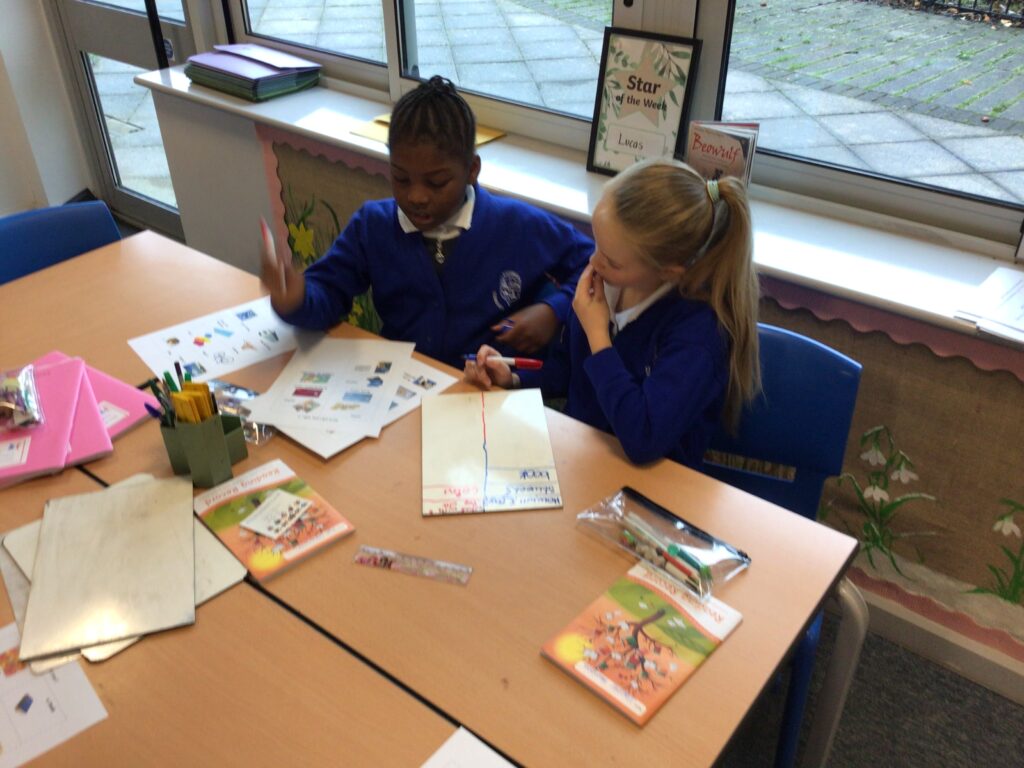

We had lots of fun in our financial literacy lesson, exploring notes and coins. We started the lesson by looking at different coins. Our teachers placed a selection of coins into a cloth bag, and we had to identify the coin by recognising the size and shape of the coin. We discussed, which coins are the easiest to identify by feel alone? Which coins are most often confused? Why is this? We agreed that when we can see the coins it is easier to identify them because of colour and information on the coin.

After that, we worked in pairs to count coins. One of us had to be the ‘counter’, the other the ‘checker’. The ‘counter’ took a handful of coins, counted them and put them into the envelope recording the total on the front using the correct notation. The ‘checker’ re-counted the coins and checks it against the amount written on the envelope – does it match? If it did not match we had to work together to count the money to reach an agreed total.

The next step was for the checker to take away an amount of money from the envelope (they recorded this on a piece of paper and kept it a secret). The counter then re-counted the money and has to work out how much money the checker has taken away. Are they correct?

We had lots of fun.

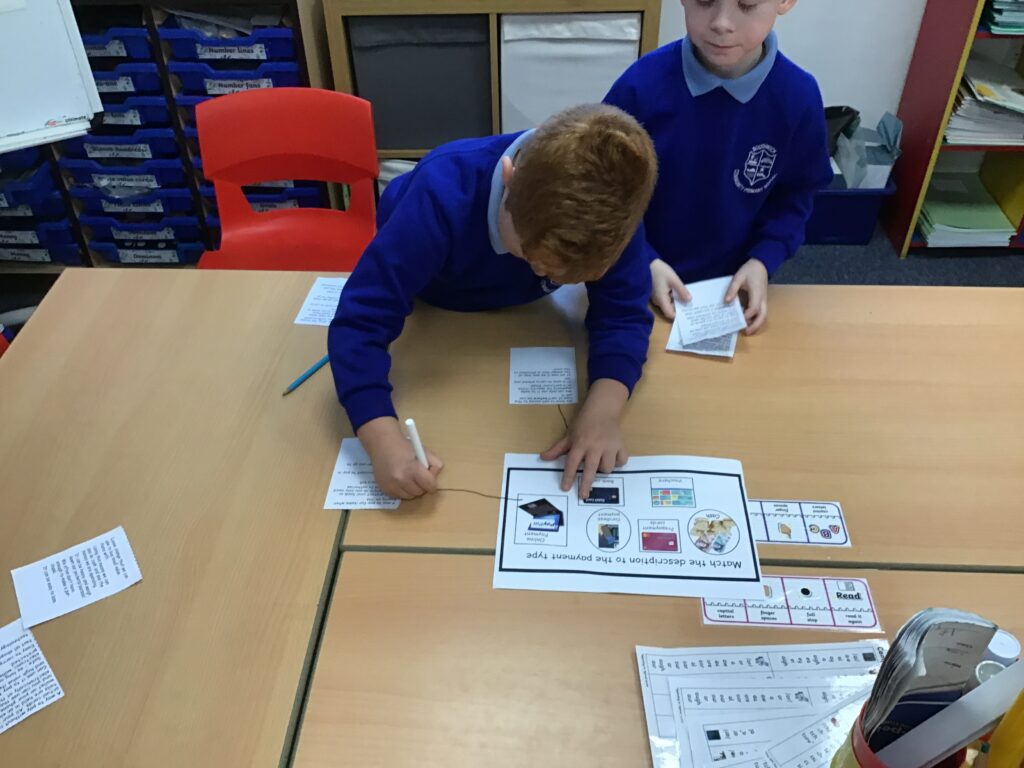

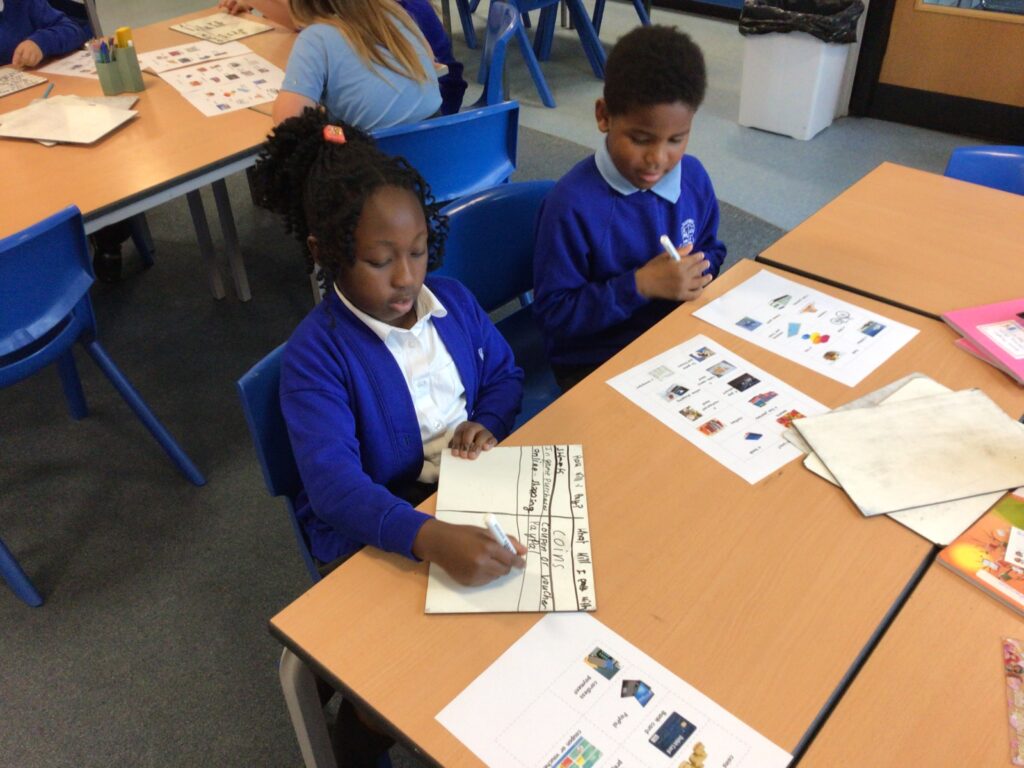

Year 3

Year 3’s financial literacy focus has been different forms of payment. The children discussed the different ways we can pay for things and their advantages and disadvantages. They couldn’t believe there were so many different ways to pay! We also discussed why we might choose a particular form of payment depending on the item you are purchasing. The children will definitely be more confident in choosing the most suitable form of payment in the future.

Year 4

This half term, we looked at what different payment methods there is and when we can use them. We discussed what they are and how, when and why we use them. We then worked in small groups and identified which payment method would be used for which transaction. We also talked about the advantages and disadvantages of using these methods. The children came up with some great answers and gave fantastic reasoning!

Year 5

Year 5 looked at what a budget was and we remembered a lot from our PSHE lessons in year 4. We looked at holidays and discussed the things we needed like accommodation and food. Then we looked at the differences and how we could save money. We had different budgets and had to create holidays based on these budgets-it was so hard to choose between lovely activities and more expensive food! We looked at a luxury holiday and how much it would cost compared to a budget holiday, then worked out how much we’d have to save per month and for how long to afford it. We are all a bit more understanding and grateful for our parents and their budgeting for holidays now.

Year 6

During their financial literacy lessons this week, the Year 6 children have been learning all about money management and the importance of making smart financial choices. They discovered that as people get older, things tend to become more expensive, and that parents often start to feel a bit more financial pressure as responsibilities grow. The children explored the costs involved in planning events such as parties and compared the difference between buying items brand new and choosing second-hand alternatives. They investigated a range of shops and online platforms, considering other people’s thoughts and opinions to help them make informed decisions. As a challenge, they even explored how to sell items they no longer need or have outgrown, using online apps such as Vinted and eBay to earn extra money that could go towards Christmas and birthday presents. It was a fantastic and eye-opening week, full of valuable life lessons, and the class are already looking forward to their next set of lessons – especially their exciting upcoming enterprise project. How do you save money? Any tips?

Comments are closed.